Reasons why debit cards get declined and learn effective solutions. Avoid hassles with expert insights. Debit cards have become an integral part of everyday transactions, offering convenience and accessibility. However, encountering a declined debit card can be a frustrating experience. Understanding the common reasons behind these declines and learning how to resolve them is crucial for a seamless financial experience.

5 Debit card declined reasons

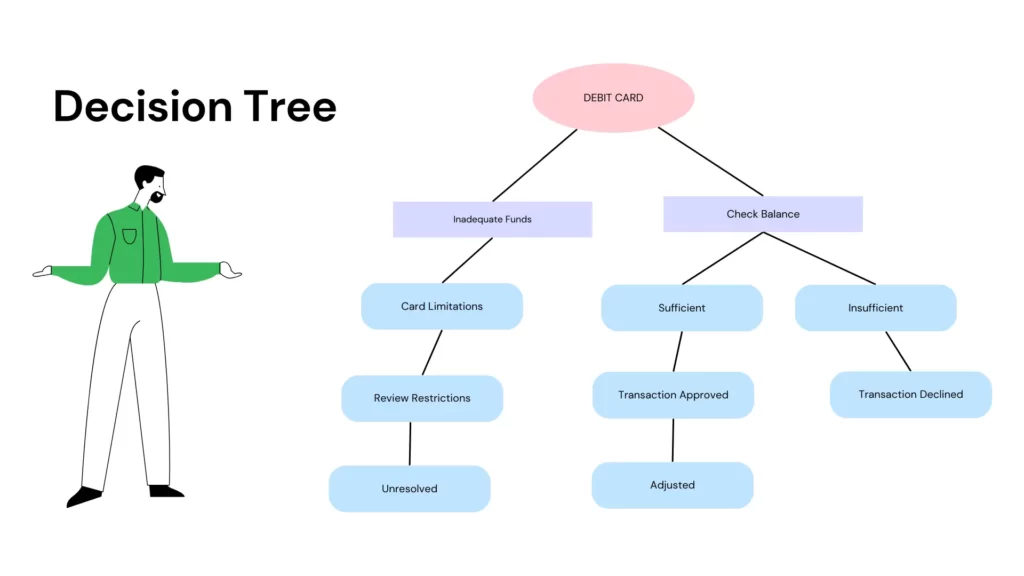

1. Inadequate Funds

One of the most prevalent reasons for a debit card decline is insufficient funds in the connected bank account. Financial institutions decline transactions when the available balance is less than the purchase amount. Regularly monitoring your account balance and ensuring sufficient funds can prevent these issues.

2. Card Limitations and Restrictions

Debit cards often come with limitations and restrictions imposed by the issuing bank. These limitations may include daily transaction limits, international spending restrictions, or temporary holds for large purchases. Checking your bank’s policies and adjusting these limitations as needed can mitigate potential declines.

3. Incorrect Information Entry

Human error in entering card details, such as mistyping the card number, expiry date, or security code, often leads to transaction declines. Double-checking and accurately inputting these details can prevent unnecessary declines.

4. Security Concerns

Fraud protection measures employed by banks might flag certain transactions as suspicious, leading to card declines. Transactions from unfamiliar locations, unusual purchase amounts, or consecutive transactions far from your regular spending pattern might trigger security alerts. Contacting your bank to confirm your identity or pre-approving certain transactions can help avoid these issues.

5. Technical Glitches

At times, technical issues either with the card itself, the payment terminal, or the bank’s system can cause declines. Re-inserting the card, trying a different terminal, or contacting customer support for assistance can resolve these technical glitches.

7 Strategies to Prevent Debit Card Declines

1. Timely Bill Payments

Late or missed bill payments might affect your available balance, leading to a declined debit card. Ensuring timely bill payments can maintain a healthy account balance, reducing the chances of facing transaction denials.

2. Regular Account Monitoring

Frequent monitoring of your account transactions can promptly identify any irregularities or unauthorized charges. Many banks offer mobile apps or online banking facilities that enable real-time monitoring, empowering you to spot and address issues swiftly.

3. Card Replacement and Upgrades

An aging or worn-out debit card might lead to technical problems during transactions. Requesting a card replacement before the card’s expiration date or upgrading to a new, more secure card can prevent such issues.

4. Communication with Financial Institutions

Maintaining open communication with your bank or credit union can be instrumental. Alerting them about travel plans, large purchases, or any significant changes in spending patterns can prevent transactions from being flagged as suspicious.

5. Understanding Merchant Policies

Certain merchants or retailers might have their own set of policies or restrictions that can lead to a declined debit card. Familiarizing yourself with these policies and ensuring your purchase aligns with their requirements can prevent transaction issues.

6. Education on Security Measures

Staying informed about the latest security measures and fraud prevention techniques can help you stay ahead of potential declines. Understanding and implementing two-factor authentication, using secure payment gateways, and practicing caution while sharing card details online can bolster security.

7. Seeking Professional Assistance

In instances where the cause of the decline remains unclear or persistent, seeking assistance from financial advisors, customer service, or even financial technology experts can provide tailored solutions to prevent future occurrences.

Employing a combination of these strategies and being proactive in managing your finances can significantly reduce the chances of encountering a declined debit card. By staying informed, taking preventive measures, and maintaining communication with financial institutions, you can ensure a smoother and hassle-free experience when using your debit card for transactions.

Conclusion

Encountering a declined debit card can be inconvenient, but understanding the common reasons behind these issues is the first step toward resolution. Regularly monitoring your account, double-checking entered details, understanding your card’s limitations, and addressing security concerns are proactive measures to prevent and resolve debit card declines.

In summary, by staying informed and proactive, you can navigate and resolve debit card decline issues swiftly, ensuring a smoother financial experience.

FAQs on Debit Card Declines

Q: Why was my debit card declined?

A: Debit card declines can occur due to insufficient funds, card limitations, incorrect information, security concerns, or technical glitches.

Q: How can I avoid debit card declines due to insufficient funds?

A: Regularly monitor your account balance and ensure sufficient funds before making transactions to prevent declines.

Q: What should I do if I encounter a declined transaction due to card limitations?

A: Review your bank’s policies, adjust limitations if necessary, and understand the restrictions to avoid declines.

Q: How can I prevent declines due to incorrect information entry?

A: Double-check and accurately input your card details to avoid mistyped information causing declines.

Q: What steps can I take to address security concerns causing card declines?

A: Contact your bank to confirm your identity, pre-approve transactions, or notify them of travel plans to avoid security-triggered declines.

Q: How can I resolve technical glitches causing debit card declines?

A: Try re-inserting the card, using a different terminal, or contacting customer support for assistance with technical issues.